USCIS Files Motion to Withdraw Appeal

USCIS MOVES TO DISMISS ITS OWN APPEAL IN THE BEHRING REGIONAL CENTER LAWSUIT

On August 23, 2021, USCIS filed a Notice of Appeal challenging the California District Court’s ruling in the Behring Regional Center LLC v. Chad Wolf, et.al lawsuit. What does this appeal mean and what do EB-5 stakeholders need to know?

To recap – what is the Behring Regional Center LLC v. Chad Wolf, et.al lawsuit about again?

Behring Regional Center filed suit against USCIS seeking to have the 2019 EB-5 Immigrant Investor Program Modernization Rule (“Modernization Rule”) invalidated on numerous grounds, including violations of the Federal Vacancies Reform Act (“Vacancies Act”). On June 22, 2021, a California judge ruled in favor of Behring Regional Center finding that the former acting Department of Homeland Security Secretary, Kevin McAleenan, was not properly serving in his position under the Vacancies Act when he effectuated the Modernization Rule, which raised the EB-5 investment from $500,000 to $900,000.

What does USCIS’ Notice of Appeal mean?

USCIS is challenging the California District Court’s decision that vacated the Modernization Rule on June 22, 2021.

Who filed the Notice of Appeal?

The Notice of Appeal was filed by new Secretary of Homeland Security Alejandro Mayorkas, Acting Director of USCIS Tracy Renaud, and USCIS Policy Branch Chief of the Immigrant Investor Program, Edie Pearson, in their official capacities.

Will new investors be required to invest $900,000 any time soon because of this appeal?

No, we believe that is very unlikely. Although USCIS filed a Notice of Appeal to challenge the District Court’s decision invalidating the Modernization Rule, thereby returning the TEA investment level to $500,000, it will take many months for the Ninth Circuit Appellate Court to reach a final decision. The Appellate Court will set a briefing schedule for the parties and a date for oral arguments. Once oral arguments are heard, the Appellate Court must then render a decision in the appeal. Once the Appellate Court renders its decision, the case may go back to the District Court for further review. We do not anticipate a decision in the Appellate case to be reached before 2022.

What is USCIS’ overarching goal in filing the appeal?

EB5 Capital believes that USCIS wants the Appellate Court to overturn the California District Court’s decision to preserve the agency’s ability to set policy, including its ability to ratify regulations that would otherwise be invalid under the Vacancies Act.

What is the main takeaway for investors who plan to file their I-526 petitions after the Regional Center program is reauthorized?

We expect the Regional Center program to be reattached to the Continuing Resolution and extended in late September 2021, without any substantive changes to the Program. We expect the investment amount to remain at $500,000 in the short term, and the aforementioned Notice of Appeal should have no immediate effect on that.

The EB-5 Regional Center Program Expires

The EB-5 Regional Center Program – You Have Questions. We Have Answers.

On June 30, 2021, the EB-5 Regional Center Program expired. During this sunset period, we have received several questions from investors that we have detailed below.

How did the Program lapse?

While the EB-5 Visa Program is permanent, the Regional Center Program is not, and it requires Congress to reauthorize the Program in order for it to continue. Since its inception in 1992, the Regional Center Program has been reauthorized over 30 times. Historically, the Program has been attached to a large spending bill and extended through a series of continuing resolutions that provide funding for the Federal Government. At the end of 2020, the Program was detached from the larger spending bill, thereby requiring it to be specifically reauthorized via a stand-alone bill. The bipartisan EB-5 Reform and Integrity Act, sponsored by Senators Chuck Grassley (R-IA) and Patrick Leahy (D-VT), enjoyed substantive support, yet the bill came short of being passed in the Senate.

Has the Program lapsed before?

Yes. The last time we experienced a lapse was during the Federal Government shutdown from December 22, 2018, to January 25, 2019. That 35-day lapse has been the longest in the Program’s history. While there were other sunsets before that, they were always tied to a short-term Federal Government shutdown.

Why didn’t the bipartisan EB-5 Reform and Integrity Act pass?

The process by which a vote on the extension of the legislation was brought to the floor would have required unanimous consent, which can be a significant hurdle. Senator Lindsay Graham (R-SC) voiced his objection which effectively blocked the extension. A Senator Graham spokesman said the Senator needed more time, despite the looming deadline. “He would like to negotiate a long-term compromise with all parties that allows for the Program to be successful while improving Program integrity.” Senator Graham has, historically, been one of the Program’s most ardent supporters, so the fact he voted no should be viewed in that light.

Why can’t the industry and Congress reach a consensus on the future of the Program?

This is a very complex program, and almost all immigration legislation is being hotly debated. While integrity reforms might be the most important item to certain groups, there are a host of other issues that are critical to others – such as the investment amount, TEA definition, processing times, visa availability, and retrogression. Additionally, EB-5 is a very small program compared to other immigration issues that must be considered and resolved.

How are immigrant petitions affected by the current lapse?

USCIS has placed pending I-924 and I-526 Petitions on hold. Investors with approved I-526 Petitions, but who have not yet gone through the Adjustment of Status process or who have not yet received their EB-5 visa at their local Consulate, are generally on hold as well. For those investors with approved I-526 Petitions who have not yet obtained their Conditional Green Cards, it is important for them to discuss their specific situations with their immigration attorneys. USCIS will continue to accept and review I-829 Petitions, including those filed on or after June 30, 2021.

Will the Program be reauthorized?

Many industry experts believe the Program could be reinstated on or prior to September 30, 2021, which marks the end of the current fiscal year. We share that optimism. The Program has proven to be a valuable economic development tool. As previously stated, there is widespread support in Congress on both sides of the aisle to resume the Program. Although it is unlikely that the Program is allowed to permanently expire, should that occur, USCIS would almost certainly legacy in all pending and approved petitions.

What will be the TEA investment amount once the Program is reauthorized?

Upon reauthorization, the minimum investment amount in Targeted Employment Areas is anticipated to remain at $500,000 USD for some period of time. There are three routes to increasing the investment amount. First, the Department of Homeland Security could reissue the recently overturned Regulations either in the same form or with revisions, although that’s not likely to occur until the Program is reauthorized. Second, the Department of Justice has until August 23, 2021, to file an appeal on the recently overturned Regulations. Third, Congress could outline a higher investment amount in a new EB-5 reauthorization bill.

After the Program returns, how long will the $500,000 USD minimum investment amount last?

If the Program is reauthorized by September 30, 2021, it will likely be another short-term reauthorization – potentially until mid-December 2021. While the most recent $500,000 USD filing window lasted a few days, this one will likely be longer. However, it is impossible to predict if or when USCIS will try to reissue the Regulations. They could move quickly, within 30-90 days after the Program is reauthorized, or they may decide to go through the full regulatory process, which could take up to two years.

If I have yet to file my I-526 Petition, can EB5 Capital assist so that I am ready as soon as the Program is reauthorized?

Yes. During this sunset period, we have two projects with available slots for new investors. Our Offerings allow for new investors to subscribe, work with their immigration counsel to prepare their I-526 Petition, and wire into escrow where funds will be held safely until the Program is reauthorized. As soon as it is, immigration attorneys can file the I-526 Petitions immediately. Given that we do not know how long the next $500,000 USD filing window will be, we wanted to provide maximum flexibility to investors who wish to get started now.

In Her Own Words: Lulu Gordon Sees a Seismic Shift in How We Work

We can’t go back to our pre-pandemic ways of thinking. Business as usual won’t do. The workforce won’t tolerate the old ways, and they shouldn’t have to. People in the U.S. and around the world finally began to comprehend what globalization means, how vulnerable we are as human beings and as a planet. Our priorities have shifted – I believe for good, and for the better.

Lulu Gordon, Senior Vice President & General Counsel, EB5 Capital

EB5 Capital Celebrates Two Multifamily Openings

WASHINGTON, June 14, 2021 (GLOBE NEWSWIRE) — EB5 Capital joins Foulger-Pratt in celebrating the opening of two multifamily developments this month in Northeast Washington, DC.

Press House and One501 both opened on June 1, 2021. Press House, EB5 Capital’s 21st project, consists of two towers with 356 apartments and approximately 15,000 square feet of ground-floor retail. One501, EB5 Capital’s 26th project, offers 327 apartment units and 9,000 square feet of ground-floor retail. Both Press House and One501 are metro-accessible and only minutes away from DC’s renowned Union Market, a gourmet food hall that has become a mecca for food connoisseurs from around the DC area. EB5 Capital and Foulger-Pratt have collaborated on three EB-5 projects together.

“We congratulate Foulger-Pratt and EB5 Capital’s 135 foreign investors on these major milestones,” said Patrick Rainey, EB5 Capital’s Senior Vice President of Investments. “Both Press House and One501 are unique in their own ways and bring incredible value to the NoMa and Eckington submarkets.”

Over the past decade, the District of Columbia has experienced a 14.6% increase in its population, representing the seventh highest urban growth rate in the United States. Most COVID-19 restrictions have been recently lifted in DC and the multifamily market is experiencing a steady increase in demand. EB5 Capital continues to focus on multifamily investments in the DC metro area and is currently raising capital for a similar project.

About EB5 Capital

EB5 Capital provides qualified investors from around the world with opportunities to invest in job-creating commercial real estate projects to obtain U.S. permanent residency, as well as private equity investments and secondary passports. For more information, visit http://www.eb5capital.com.

Two New Restaurants by José Andrés Coming to NYC Ritz-Carlton

We are excited to announce that José Andrés will be opening two restaurants at our JF22 Project – NYC Ritz-Carlton. The hotel is currently under construction and is scheduled to open in the NoMad District in Manhattan this fall. For more information on José Andrés’ plans for JF22’s food and beverage space, please read this article.

Investor Portal Now Available

We are excited to announce the launch of our new Investor Portal. Through our secure portal, our investors will gain direct access to important information related to their EB-5 investment, including project documents, investor reports, construction camera links, USCIS immigration notices, case processing times, relevant tax forms, and more. To best manage this launch, our team will roll out the portal to our investors and partners in phases (by project) over the course of 2021. To our investors who have already been invited to join the portal, we encourage you to explore all the wonderful features offered by the new platform and provide feedback to us. Your input is valued, and we would appreciate hearing from you. We are thankful for your support and we look forward to sharing this new service with you! If you have any questions about the portal, please contact eb5portal@eb5capital.com.

Bloomberg, The Future of Office Spaces

CEO & founder of EB5 Capital, Angel Brunner, speaks to Bloomberg Markets about the future of commercial real estate in the post-pandemic world.

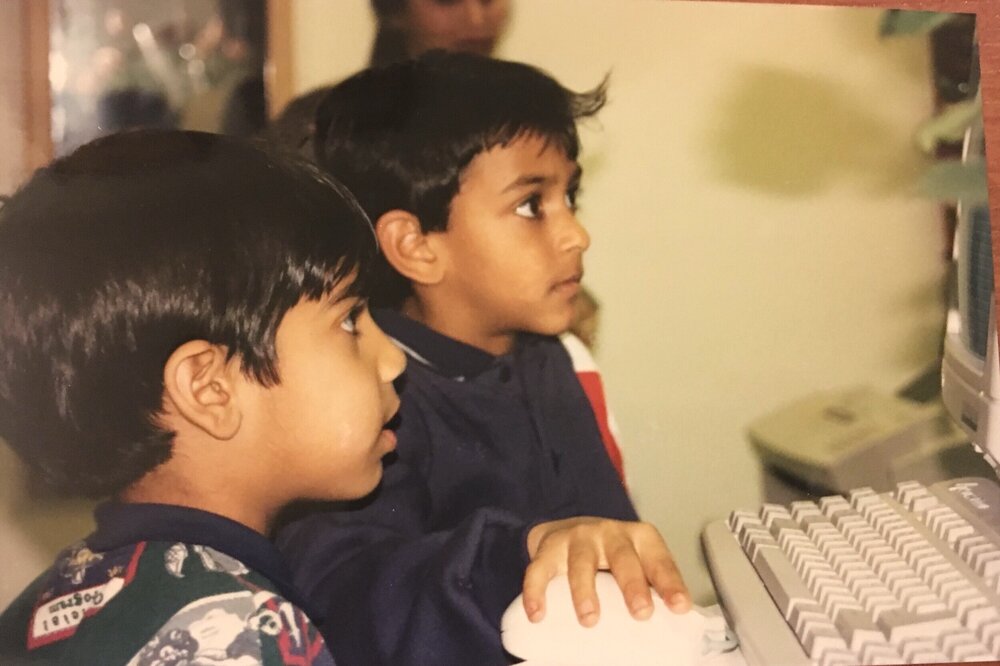

Investing in Shared Values and Indian Cuisine

RASA (for RAhul + SAhil) is a fast-casual Indian restaurant with multiple locations throughout Washington, DC metro area. Their first location was in DC’s Navy Yard neighborhood, where EB5 Capital has raised funds for three multifamily EB-5 projects totaling over $80 million.

EB5 Capital’s CEO, Angel Brunner, recently made a personal investment in Rahul and Sahil’s business (watch Angel make her first RASA bowl) contributing to the vision of diverse, global experiences inside of our company’s home city.

RASA’s story is a story of childhood friends on the fast-track with careers in investment banking and management consulting, until one day, they hit the brakes, changed course, and followed their dream. Rahul and Sahil were introduced to restaurant ownership when their fathers (old friends from India) moved to the U.S. in the 1980s and opened their first restaurant together in Rockville, Maryland in 1991.

Following in their fathers’ footsteps, they dreamt of opening their own Indian restaurant, but with one twist – to make Indian cuisine more accessible to Americans. After brief stints pursuing corporate careers in big cities, Rahul and Sahil opened their restaurant in 2017.

Angel Brunner Joins Yahoo Finance to Discuss Pandemic’s Impact on CRE

Angelique Brunner, EB5 Capital founder and CEO, joins Yahoo Finance’s Alexis Christoforous to discuss the impact of the pandemic on commercial real estate.

New York YIMBY: NYC Ritz-Carlton Exterior Nears Completion

Façade work is getting closer to completion on the NoMad Ritz Carlton, a 580-foot-tall hotel skyscraper at 1185 Broadway.